In construction, delays don’t just slow you down—they hit your bottom line. Whether it’s upfront supplier costs, delayed client payments, or growing demand on your project pipeline, having access to working capital is crucial for subcontractors. That’s why The Build Chain now offers a flexible credit facility that helps you break the cash flow bottleneck and keep your projects moving.

A Credit Line Designed for Construction

Subcontractors can now access up to £1,000,000 in credit, exclusively through The Build Chain platform. Whether you’re looking to spread the cost of materials, manage recurring business expenses, or break down large supplier payments into manageable terms, our built-in credit solution gives you the financial agility to keep building—without compromise.

Why Use The Build Chain’s Credit Facility?

✅ Improve Cash Flow

Free up working capital from your accounts payable and keep your projects moving forward.

✅ Flexible Repayments

Choose terms between 1 to 12 months, with simple, transparent fees per invoice—no surprises.

✅ Scales With You

Your credit line grows with your business performance, giving you the flexibility to take on more work as you expand.

✅ Fast, Easy Access

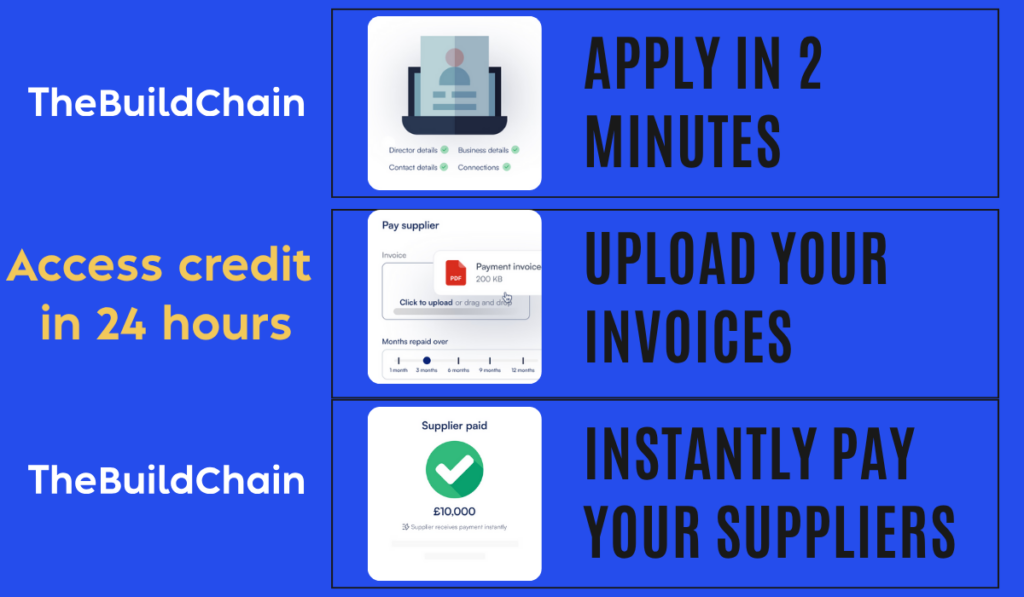

Apply in just a couple of minutes, upload your invoices, and get supplier payments processed quickly—sometimes within 24 hours.

✅ Maintain Supplier Trust

Suppliers continue to see your name on every invoice, maintaining your relationship and reputation.

Finance Built for Builders

This isn’t traditional lending with layers of admin and long wait times. The Build Chain’s credit facility is designed specifically for construction businesses—especially subcontractors who are often underserved by mainstream finance.

No complex paperwork. No long approvals. Just a practical, transparent way to get funding when you need it most.

Don’t Let Cash Flow Be the Roadblock

We’ve seen first-hand how even strong subcontractors can get held back by gaps between payments and expenses. With access to a flexible credit line through The Build Chain, you can bridge that gap and power forward with confidence.

Ready to grow—without the cash flow strain?

Talk to our team today about activating your credit facility and discovering what’s possible when your procurement and finances are finally aligned.