You may think “I have control of my business finances” or worse “I have a good strong accountant, bookkeeper of even Commercial Director”. Unfortunately, we see this across the industry through our network of partners time and time again and in a recent survey this was more stark than ever.

Through a recent survey of hundreds of contractors, 75% of these firms faced the same dilemma, How do I make sure that I have good financial stability, Do I need to hire a dedicated Finance Director or senior finance representative?

Concerningly, 82% of these firms answered to No to hiring a full time or fractional FD, leading to these firms going bust.

Give me the detail!

In 2024, a staggering 82% of 200 surveyed UK construction companies collapsed, with a common thread running through their demise, the absence of a dedicated Finance Director (FD) or Chief Financial Officer (CFO). Our recent survey of these businesses revealed a harsh reality, 75% of construction leaders faced the critical decision of whether to hire a fractional or full-time FD, and 82% of those who opted against it went under. The numbers are sobering, but the stories behind them are even more alarming.

A Liquidator’s Alarming Report

Of the 127 construction companies that collapsed in 2024, 104 shared a fatal flaw: no Finance Director. One case stands out as particularly devastating:

- £23m turnover business.

- 84 families now left without income.

- Owner’s belief: “We were profitable.”

- Administrators now sifting through the wreckage.

The owner’s words cut deep: “We were making money on every job.” Yet, their business crumbled. Why? The survey asked basic financial questions, and the responses exposed critical gaps:

- Who handles the finance? “Our bookkeeper and accountant.”

- When was your last cash flow forecast? “We check the bank balance daily.”

- What’s your pipeline and WIP position? Blank stare.

The Brutal Truth

The distinction between roles is stark:

- A bookkeeper records the past.

- An accountant reports the past.

- A Finance Director/CFO protects the future.

In construction, it’s common for a Managing Director (MD) or Commercial Director to oversee finance which is a dangerous mistake. Commercial Directors are skilled at winning contracts, not forecasting cash flow or managing financial risk. This misalignment fuels a cycle of failure.

Why Construction Companies Fail

Our survey pinpointed the key reasons behind these collapses:

- Reactive decision-making: Acting on instinct rather than data.

- Poor cash management: No visibility into liquidity or forecasting.

- Weak financial controls: Lack of oversight on costs and margins.

- No strategic planning: Failing to anticipate market or project risks.

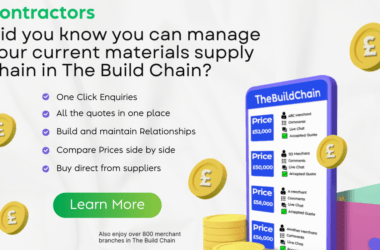

- Minimal investment in technology: Manual processes for quoting, pricing, ordering, and finance increase costs and errors.

What a Finance Director Actually Does

A Finance Director isn’t just a number-cruncher; they’re a strategic partner who safeguards your business. Their role includes:

- Financial strategy: Aligning budgets with long-term goals.

- Risk management: Identifying and mitigating financial threats.

- Funding relationships: Securing loans or investment on favourable terms.

- Commercial decisions: Guiding pricing, contracts, and profitability.

- Working capital management: Ensuring cash flow supports operations.

- Detailed cash flow forecasting: Planning for lean months or unexpected costs.

- Identifying Technology: ensuring the business doesn’t just do what they have always done.

The Cost of Inaction

Hiring a Finance Director, whether full-time or fractional can seem expensive. Depending on their involvement, costs vary, but the price of not having one is far steeper which can lead to the collapse of a viable business. Similarly, investing in technology to automate quoting, pricing, ordering, and finance can feel like a stretch. Yet, manual processes inflate staff costs and erode margins, making automation a smarter long-term bet.

The Bottom Line

The survey’s message is clear: cash is a fact, but success is no accident. Construction leaders who rely on bookkeepers, accountants, or overstretched Commercial Directors are gambling with their company’s future. A Finance Director brings the expertise to navigate the industry’s unique challenges, volatile cash flows, tight margins, and project delays.

Invest in Tech, Invest in Tech, Invest in Tech!

Don’t let your business join the 82% that failed. Invest in proper financial leadership and technology to secure your future.

Contact us to explore how improving your financial posture can transform your business, or register here to Speak to one of our experts or simply email us to ask us anything sales@thebuildchain.co.uk